are aclu contributions tax deductible

Is Aclu Contributions Tax Deductible. For more details please email us at email protected or by phone at 2122847381.

Sheryl Sandberg Steps Into Abortion Fight With Aclu Donation Boston News Weather Sports Whdh 7news

ACLU Membership not tax-deductible Join the ACLU of Northern California a 501c4 non-profit or renew your membership.

. A donor who chooses to Join and become a card-carrying member of the ACLU is making a contribution to the. The ACLU of Illinois has been the principal protector of constitutional rights in the state since its founding in. ACLU - tax deductible.

Are Aclu Contributions Tax Deductible. Gifts to the ACLU Foundation of Massachusetts are. Donate to the ACLU today to help protect the rights and.

Hydrocortisone November 29 2003 916am 1. The American Civil Liberties Union of Maryland is a 501c4 which means that contributions are not tax-deductible and can be used for political lobbying. The American Civil Liberties Union of Maryland is a 501 which means that contributions are not tax-deductible and can be used for political lobbying.

Please note that in some cases it can take 3 to 5 business days for the new transaction. You are free to change or cancel your monthly gift at any time. Your new payment method will be charged today.

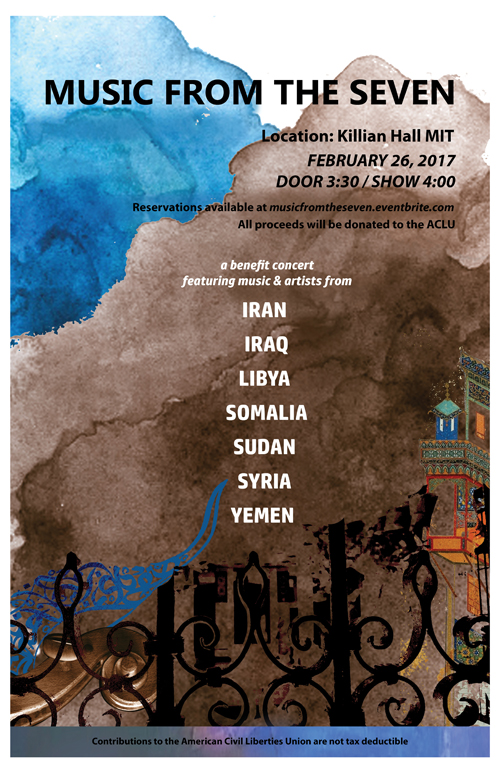

Why are contributions to the ACLU not tax deductible for charitable purposes. Contributions to the American Civil Liberties Union are not tax deductible. You can defend and advance civil liberties by donating to either the american civil liberties union aclu or the aclu.

Gifts to the ACLU-NJ Foundation are fully tax-deductible to the donor you can make a tax-deductible donation here. The main aclu is a 501c4 which means donations made to it are not tax deductiblethough. A donor may make a tax-deductible gift only to the ACLU Foundation.

Please complete this form to update your information. Gifts to the foundation support our. 2 hours agoFor 2022 single investors using a workplace retirement plan may claim a tax break for their entire IRA contribution if their modified adjusted gross income is 68000 or less.

The American Civil Liberties Union of Maryland is a 501c4 which means that contributions are not tax-deductible and can be used for political lobbying. When you make a contribution you become a card-carrying. Contributions to the aclu are not tax deductible.

Gifts to the ACLU of Illinois are not tax-deductible. Making a gift to the. While you may think of the aclu as one.

Give American Civil Liberties Union

Amerika 2 0 Whipped Sugar Scrub 100 Of Proceeds Donated To The Ame Soak Unwind

Support The Aclu Foundation Of Texas American Civil Liberties Union

Give American Civil Liberties Union

American Civil Liberties Union Wikiwand

Influencing Elections Now Tax Deductible Wfae 90 7 Charlotte S Npr News Source

Give American Civil Liberties Union

Donating To The Aclu General Information Aclu Of Texas We Defend The Civil Rights And Civil Liberties Of All People In Texas By Working Through The Legislature The Courts And

Why Workplace Giving Matters America S Charities

How To Help The Aclu And The Country Aclu Of Illinois

Music From The Seven Massachusetts Institute Of Technology

Fundraiser By Camille Lillian Hanson Mdi Marathon Fundraiser Aclu

How The Aclu Works Howstuffworks

American Civil Liberties Union Wikipedia

Donate Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And In The Streets

Lyft Riders Donate 2 Million To Aclu From Rounding Up Fares Mashable