vehicle sales tax in memphis tn

View and print an Application for Replacement Title instructions for completion are included with the form. Exact tax amount may vary for different items.

The minimum combined 2022 sales tax rate for Memphis Tennessee is.

. Memphis TN Sales Tax Rate. The minimum combined 2021 sales tax rate for memphis tennessee is. For example if you buy a car for 20000 then youll pay 1400 in state sales tax.

The Shelby County sales tax rate is. Tax Rate The 2021 tax rate is 2713049 per 100 Assessed Value. There is no applicable special tax.

Other taxes collected by the City of Memphis include Payment in Lieu of Taxes PILOT and Central Business Improvement District CBID taxes for taxable entities in the Downtown Center City District. The highest the combined citycounty rate can be is 275. The Tennessee state sales tax rate is currently.

The fee to replace a title or note a lien is 13. Please keep in mind that each county may also have a wheel tax and local tax which vary depending on the county. 732 S Congress Blvd Rm 102.

This is the total of state county and city sales tax rates. February 09 2022 0805. The 2018 United States Supreme Court decision in South Dakota v.

The average cumulative sales tax rate in Memphis Tennessee is 974. You can print a 975 sales tax table here. 2022 Tennessee state sales tax.

Midway TN Sales Tax Rate. Mercer TN Sales Tax Rate. Within Memphis there are around 54 zip codes with the most populous zip code being 38134.

The December 2020 total local sales tax rate was also 9750. James L Jimmy Poss. To review the rules in Tennessee visit our.

The Tennessee sales tax rate is currently. Meigs County TN Sales Tax Rate. The replacement of titles and noting of liens can be processed and picked up or mailed in 3 business days.

The most expensive standard sales tax rate on car purchases in general is found in California. Pay your Property Taxes Online. Milan TN Sales Tax Rate.

This is the total of state and county sales tax rates. Smithville TN 37166. Middle Valley TN Sales Tax Rate.

Blountville TN 37617. However certain states have higher tax rates under certain conditions. Memphis collects the maximum legal local sales tax.

The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis tax. Typically automobile and boat sales in Tennessee are subject to sales or use tax. Has impacted many state nexus laws and sales tax collection requirements.

Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2614 on top of the state tax. The County sales tax rate is. See reviews photos directions phone numbers and more for the best Vehicle License Registration in Memphis TN.

Memphis TN Sales Tax Rate. The few exceptions to this rule are when vehicles or boats are sold. Purchase Location ZIP Code -or- Specify Sales Tax Rate.

Vehicle Sales Tax Calculator. Michie TN Sales Tax Rate. The current total local sales tax rate in Memphis TN is 9750.

That tax rate is 725 plus local tax. Midtown TN Sales Tax Rate. Occasional and isolated sales of motor.

Memphis is located within Shelby County Tennessee. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. For more information please call the Shelby County Clerks Office at 901 222.

Middleton TN Sales Tax Rate. The average sales tax rate on vehicle purchases in the United States is around 487. Purchasers of new and used vehicles must pay state sales tax at the rate of 7 percent and the state single-article tax at the rate of 225 percent.

The Memphis sales tax rate is. VTR-34 - Sales Tax on a Vehicle Purchase. How Much is the Average Sales Tax Rate on Cars.

This includes the rates on the state county city and special levels. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. Title fees should be excluded from the sales or use tax base when Motor vehicle or boat is subject to the sales or use tax.

Between spouses siblings lineal relatives parents and children grandparents and grandchildren great grandparents and great grandchildren or spouses of lineal relatives. COUNTY CLERK SALES AND USE TAX FOR AUTOMOBILES BOATS 4 Taxation of Automobile and Boat Sales Automobile Sales Under Tennessee sales and use tax law sales of motor vehicles trailers and off-highway vehicles are sales of tangible personal property subject to sales or use tax.

4547 Almo Ave Memphis Tn 38118 Mls 10101975 Zillow

424 N Avalon St Memphis Tn 38112 Realtor Com

Lowest Gas Prices In Memphis Area

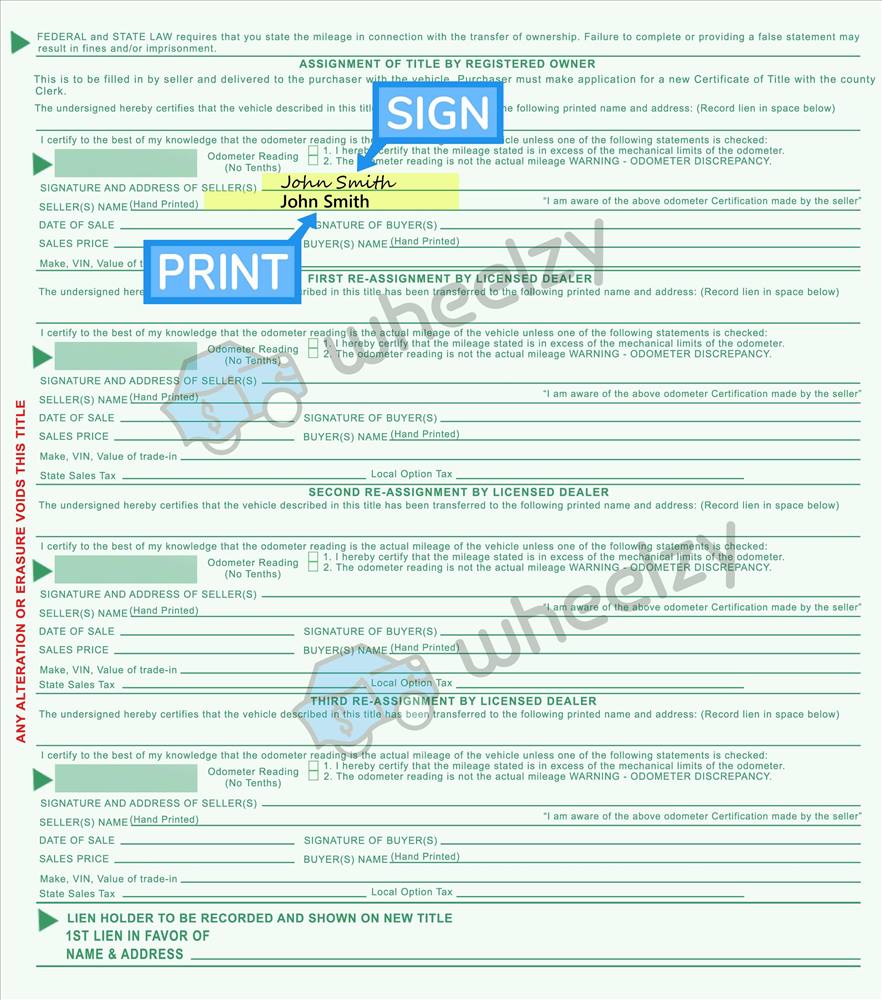

How To Sign Your Car Title In Memphis Including Dmv Title Sample Picture

1506 Birdsong Ave Memphis Tn 38106 Zillow

Memphis Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax On Cars And Vehicles In Tennessee

1705 Quail Hollow Rd Memphis Tn 38120 Realtor Com

1745 Myrna Ln Memphis Tn 38117 Realtor Com

3620 Hallbrook St Memphis Tn 4 Beds 2 Baths Exterior Brick Memphis Real Estate Sales

1940 Snowden Ave Memphis Tn 38107 Realtor Com

3785 W Germanwood Ct Memphis Tn 38125 Mls 10121042 Redfin

1324 Harbert St Memphis Tn 38104 Mls 10125981 Redfin

It S Official Top Golf Is Coming To Memphis

10 Pros And Cons Of Living In Memphis Tn Right Now Dividends Diversify

1200 Winfield Ave Memphis Tn 38116 Realtor Com

730 Hale Rd Memphis Tn 38116 Realtor Com

Memphis Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders